Finding it difficult to save the deposit that will see you buy your dream home? Don’t worry you’re not alone, but there are ways that can help!

Chances are you are not used to the concept of budgeting. Budgeting allows us to set objectives, reach our objectives and measure how well we are progressing along the way.

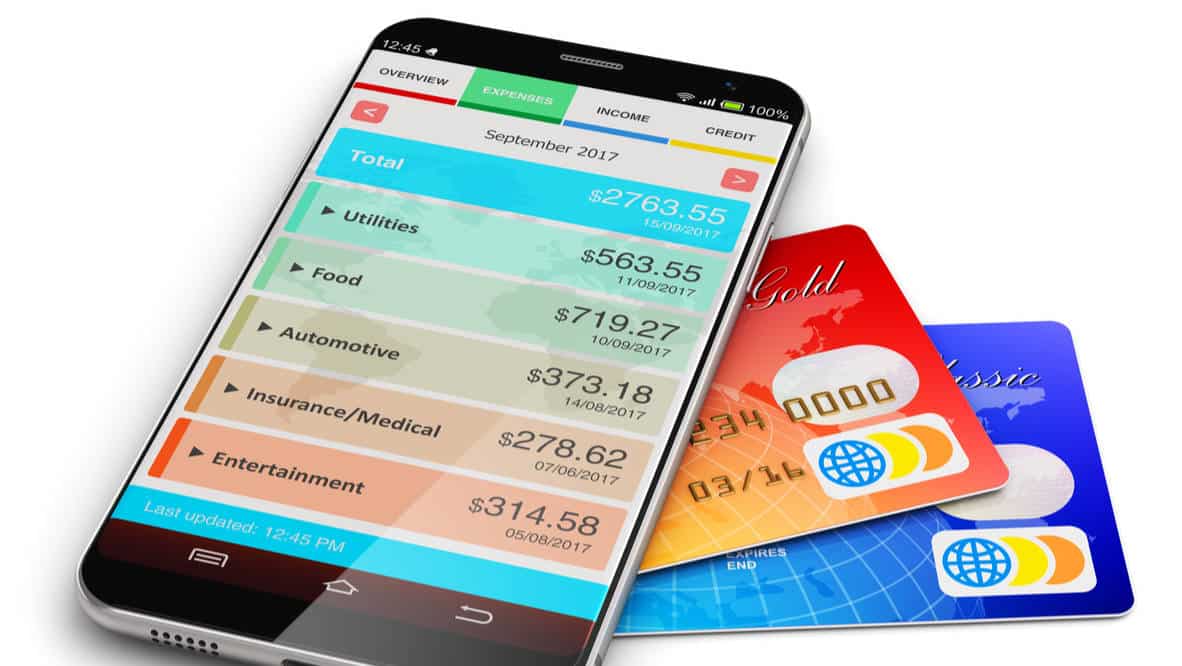

Budgeting has become easier with the use of technology as many Apps are readily available that can be linked to your bank accounts and make the process of budgeting easier and even fun! These Apps not only allow you to budget, but they also provide accurate information to track your expenditure and savings. Finally, the App runs on your mobile telephone and is readily available wherever you are at any time of the day.

Some of the Apps out there include, PocketBook, Moneytree, Trackmygoals and Trackmyspend and moneybrilliant

Trackmyspend is provided by the Australian Securities and Investment Commission and is also available for free.

Moneybrilliant has both a free version with some good features or you can get the full features for a monthly or yearly fee.

There are many more on the market and we encourage you to do your own research and find the right one for you. Most large lenders also provide some form of budgeting tool that is linked to your accounts.

Why Budget

Have you ever considered where your money is spent each week? Rushing from A to B each day, we encounter road tolls, extra cappuccino, a few drinks after work, a visit to the local takeaway for dinner or lunch or a great deal on the internet. All of these happen generally without much thought, however, all of them will influence how long you will take to save the much-needed deposit for your first home.

A budget, allows you to work back from how much you earn, allowing you to categorise your expenses into cannot do without versus optional. Each of us will define differently what we cannot do without, therefore it is up to you to establish this and then deal with how much you will budget for the optional expenses.

Keep in mind that even rent is an expenditure that you can influence if you keep a close eye on the market and take advantage of opportunities in the market.

Once your budget is set, you will have a clear idea of how much you will save each month and a timeline for the date on which your first home deposit will be ready.

Our team at Brisbane Home Loans can assist you in creating your budget and reducing your expenditure. By doing this, you will also improve your credit rating which is very important to your future lender.