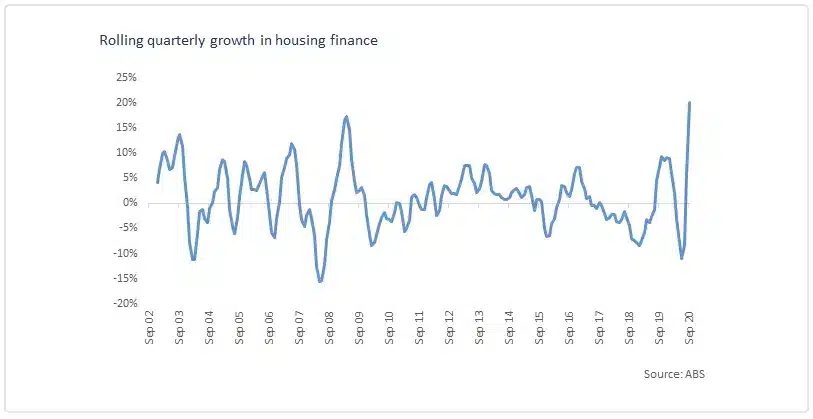

After a shocking low demand for housing in the June quarter, the volume of finance secured for property purchases has seen a strong rebound this September quarter. The latest ABS housing finance data shows a quarterly increase of 20.0%, which is the highest quarterly growth rate on record.

With the highest levels since the March 2018 quarter, housing finance for the purchase of property totalled $62.7 billion in the September quarter. This comes after mortgage rates dropped to a historical low, after social distancing restrictions ease across the country which subsequently led to a rise in consumer sentiment and an increase in sales and listing volumes. CoreLogic has estimated that sales volumes have increased by roughly 27.7% in the September quarter, and indicates a further increase in housing finance over October and November.

Of all the states and territories, Queensland accounted for most of the increase in lending for the purchase of property. The value of housing finance commitments increased 40.2% over the September quarter, which accounts for approximately 31% of the uplift nationally. Despite Victoria’s extended restrictions on the transaction of property, the state still saw an uplift of 4% in the value of finance purchase of a property.

As the RBA handed down a further reduction in bank funding costs over November, and mortgage rates continue to fall, refinancing should remain elevated. However, most discounted funding costs for banks are being passed through to fixed rate loan products. Exit fees that can be associated with fixed rate home loans may constrain refinance activity down the line, as the current wave of borrower will be locked into fixed-rate arrangements.

CoreLogic estimates lending for the purchase of property will continue to remain elevated, however, the dramatic increase in finance is unlikely to maintain such a strong trajectory, and quarterly growth rates in housing finance volumes are likely to slow.

Owner Occupiers Continue to Dominate Lending

Owner occupiers accounted for 85.6% of the uplift in money lent for the purchase of housing in the September quarter. First Home Buyers had the highest rate of growth in secured finance, at 24.4%, compared to investors who had an uplift of 11.3%.

Investor participation in the housing market has been trending down since a national property market downturn in 2017. In addition, COVID-19 has exacerbated the retreat of investors and rise of First Home Buyers, as there was an elevated risk in investor-grade stock and government stimulus tailored to First Home Buyers.

First Home Buyer purchases may be limited in the upcoming year as grants and concessions wind down, and house prices rise off the back of low mortgage rate settings. This could offset a lift in investor participation as prospects for capital gains solidify and more properties return a positive cash flow thanks to such extremely low interest rates.

If you are thinking about taking advantage of these low mortgage rates, let us help you with purchasing your first home. Fill out the form below, and one of our team members will be in touch to discuss your options!